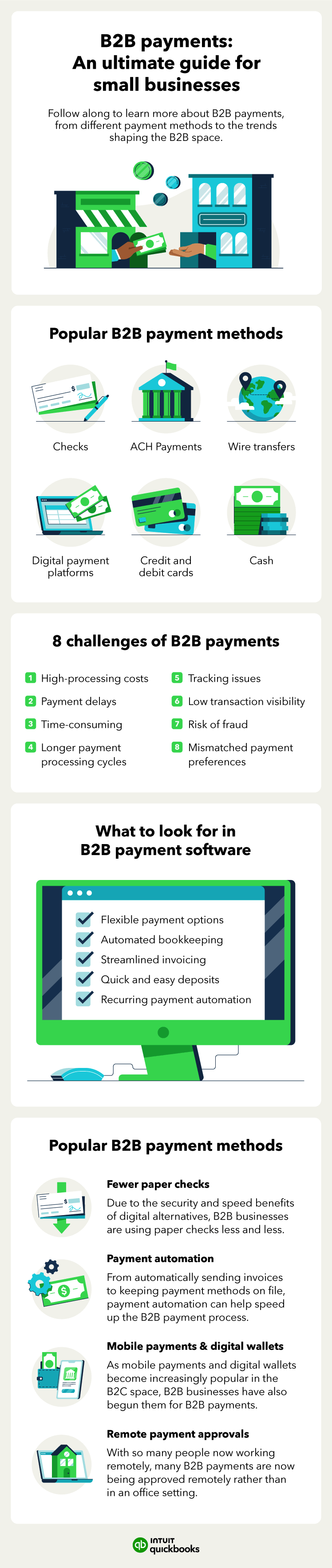

Accepting checks as a payment method can result in a less secure transaction. Checks are a major source of fraud because they lack the security measures of cards and electronic payments and can be easily faked or replicated.

Still, the key benefit to checks is that they are often used as an alternative to avoid credit card processing fees.

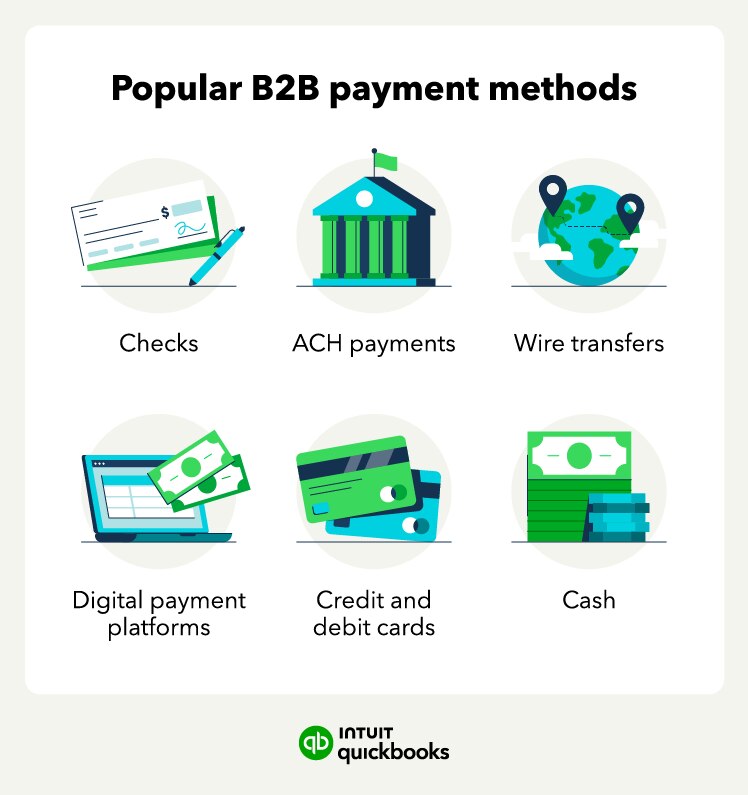

ACH payments

Automated Clearing House (ACH) transfer is an electronic payment option that transfers money directly from the payee’s financial institution to yours. ACH transfers can take up to three days to complete.

However, ACH payments are highly secure and typically completed at no additional fee to the buyer or seller. eChecks are a common type of ACH payment.

Wire transfers

Wire transfers electronically move funds from a buyer to your bank account. This process is generally faster than an ACH transfer, allowing for real-time payments because businesses can transfer funds via a financial network. Wire transfers are typically completed within a few hours, taking up to one business day at the longest.

Remember that international bank transfers can take longer and incur higher payment processing fees, depending on the service provider.

Over the last few years, B2B payment solutions have grown significantly, thanks to innovations in payment processing and fintech, as well as the rise of e-commerce businesses.

Digital payment platforms

Another popular B2B payment option is the use of digital payment platforms, such as:

- PayPal

- Google Pay

- Apple Pay

- Venmo

These digital payment platforms allow businesses to place a payment in real-time, making it a more convenient option than other small business payment methods, such as paper checks.

You can make B2B payments using digital payment platforms via a website or mobile app. One downside to digital B2B payment services is that you’ll likely have to pay a transfer fee while sending or withdrawing a payment.